|

People save money for a variety of reasons, which include large future purchases (higher education, vehicles, and homes), entrepreneurial endeavors, retirement and unexpected events. Check out the .gif of Tiana from the Princess and the Frog. What is her savings goal? She works as a waitress in a restaurant in New Orleans. How do you think she can save money for her fund? To continue this lesson with students, download the Student Guide and Tampa Bay Times Saving Tips article. In the article, they discuss the power of compound interest. In order to learn more about compound interest, use the EconEdLink compound interest calculator to see how it works! Compose a tweet or instagram post about the power of compound interest. To learn more about Budgeting and Saving, check out the engaging interactive by Financing Your Future MyFloridaCFO. Then, research the different programs and incentives offered by financial institutions, workplaces, and the government. Standards SS.8.FL.3.6 Identify the value of a person’s savings in the future as determined by the amount saved and the interest rate. Explain why the earlier people begin to save, the more savings they will be able to accumulate, all other things equal, as a result of the power of compound interest. SS.8.FL.3.7 Discuss the different reasons that people save money, including large purchases (such as higher education, autos, and homes), retirement, and unexpected events. Discuss how people’s tastes and preferences influence their choice of how much to save and for what to save. SS.912.FL.3.6:Describe government policies that create incentives and disincentives for people to save. SS.912.FL.3.7:Explain how employer benefit programs create incentives and disincentives to save and how an employee’s decision to save can depend on how the alternatives are presented by the employer. Here is a Nearpod Lesson to use with the article!

Use the guide below to walk your students through the lesson and you can download a copy of the student guide to print out for your students. Here is the copy of what “J” wrote to Penny, in the Tampa Bay Times. Florida Financial Literacy Standards

SS.912.FL.4.5: Explain that lenders make credit decisions based in part on consumer payment history. Credit bureaus record borrowers’ credit and payment histories and provide that information to lenders in credit reports. SS.912.FL.4.6: Discuss that lenders can pay to receive a borrower’s credit score from a credit bureau and that a credit score is a number based on information in a credit report and assesses a person’s credit risk. SS.912.FL.4.7: Describe that, in addition to assessing a person’s credit risk, credit reports and scores may be requested and used by employers in hiring decisions, landlords in deciding whether to rent apartments, and insurance companies in charging premiums. SS.912.FL.4.8: Examine the fact that failure to repay a loan has significant consequences for borrowers such as negative entries on their credit report, repossession of property (collateral), garnishment of wages, and the inability to obtain loans in the future. SS.912.FL.4.9: Explain that consumers who have difficulty repaying debt can seek assistance through credit counseling services and by negotiating directly with creditors. SS.912.FL.4.10: Analyze the fact that, in extreme cases, bankruptcy may be an option for consumers who are unable to repay debt, and although bankruptcy provides some benefits, filing for bankruptcy also entails considerable costs, including having notice of the bankruptcy appear on a consumer’s credit report for up to 10 years. Check out and download our new student guide for this lesson!

“I Am Gonna Move Out!” When is the last time these words have run through your mind? Maybe an argument with the ‘rents about keeping up with chores or obeying curfew? Parental Units just don’t understand the modern teenager’s daily stress and upkeep. Academic life, friends, high school drama, athletic events, social media and that part-time job! What parents do understand is that as a financial guardian, they are looking out for their teen’s best interests. The standard of living parents have as an adult took decades to accumulate. Many teens today hope to move out of their parent’s home and into a comparable living environment, sacrificing no standard of living. That is absolutely not an attainable goal at today’s minimum wage. The federal government has priced fair wages at $7.25 an hour. Most teens work minimum wage jobs and do not attain a full 40 hour work week. Read the attached article and discuss why minimum wage earners are struggling to pay for their own place.

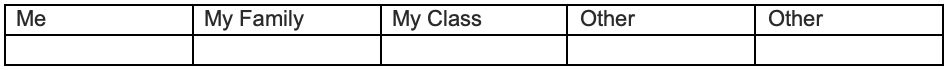

Take a moment and write down your expected living expenses when living on your own. Assign a dollar amount to each of your items. How much money will you have to earn at minimum to keep this determined standard of living. Florida has set their state minimum wage at $8.46 an hour. How many hours would you have to work at this rate to pay your monthly bills?

Share your list and your work findings with a partner. Did you forget any expenses? Did either of you take out taxes, FICA medicare, or social security? At 40 hours a week, working for a full 52 weeks of the year, the federal tax rate is 12%. Find out how much you will pay in taxes each pay period. Investigate how much money will come out of your pay and go to medicare and social security. Find your new disposable income after all taxes have been removed. Relook at what 30% (recommended housing expenditures- including utilities) can really buy in your part of town. When the article refers to a “modest apartment” what does that mean? What does “modest” mean to you? How does your idea compare to the federal government? Extension: Explore the apartments that are available for rent in your area by conducting a search online. How many can you find that meet the federal government’s idea of “modest housing?” Create a brochure designed to attract teens on how far their paycheck may take them without help from Mom and Dad. Florida Literacy Standards: SS.912.FL.1.6: Explain that taxes are paid to federal, state, and local governments to fund government goods and services and transfer payments from government to individuals and that the major types of taxes are income taxes, payroll (Social Security) taxes, property taxes, and sales taxes. SS.912.FL.1.7: Discuss how people’s sources of income, amount of income, as well as the amount and type of spending affect the types and amounts of taxes paid. SS.912.FL.2.1 Compare consumer decisions as they are influenced by the price of a good or service, the price of alternatives, and the consumers income as well as his or her preferences. SS.912.FL.2.2 Analyze situations in which when people consume goods and services, their consumption can have positive and negative effects on others. SS.912.FL.2.3 Discuss that when buying a good, consumers may consider various aspects of the product including the product’s features. Explain why for goods that last for a longer period of time, the consumer should consider the product’s durability and maintenance costs. Watch the video clip from Monsters University. What does this video clip say to you about college? What are some other considerations you have to make when planning for your future? Use the guide to help students learn about student loan decisions. Here is the Dear Penny article to view and download. To learn more about student loans, check out the Finance Your Future MyFloridaCFO engaging interactives on college and student loans. We have also created a Nearpod to use with students. Check out the Preview link or use the Editable link to download to your Nearpod account. Financial Literacy Standards SS.912.FL.2.2 Analyze situations in which when people consume goods and services, their consumption can have positive and negative effects on others. SS.912.FL.4.8 Examine the fact that failure to repay a loan has significant consequences for borrowers such as negative entries on their credit report, repossession of property (collateral), garnishment of wages, and the inability to obtain loans in the future. SS.912.FL.4.9 Explain that consumers who have difficulty repaying debt can seek assistance through credit counseling services and by negotiating directly with creditors. SS.912.FL.4.10 Analyze the fact that, in extreme cases, bankruptcy may be an option for consumers who are unable to repay debt, and although bankruptcy provides some benefits, filing for bankruptcy also entails considerable costs, including having notice of the bankruptcy appear on a consumer’s credit report for up to 10 years. Con the Con-Artist Play the player, hustle the hustler, sweet-talk the swindler, dupe the double-crosser . . . It’s the kind of scam that makes your skin crawl. The radio reports a sweet, little 83 year old lady paid for a new roof, only to find the workers took the money and ran. The Prince of Insert Foreign Country Here has a son that needs medical attention, and your ability to wire him money is the difference between life and death. We have all heard these time old tales whereby an innocent do-gooder gets sucked in and succumbs to the financial death of a money predator. Well, how about trying to be just an average citizen and pay your electric bill on time? Why would this be a scam? The deceitfully, greedy individuals who would rather have your money, than you have your electric have found a way. Read the Tampa Bay Times article Power Company Warns of a Scam. After reading, and create a flyer to educate consumers on how to safeguard their money from scammers. Check out the student guide we created to use with the article. Preview the Nearpod lesson we created to accompany this article. You can also use the Editable Link to save to your Nearpod account Florida Financial Literacy Standards SS.912.FL.2.7Examine governments establishing laws and institutions to provide consumers with information about goods or services being purchased and to protect consumers from fraud. SS.912.FL.6.9Explain that loss of assets, wealth, and future opportunities can occur if an individual’s personal information is obtained by others through identity theft and then used fraudulently, and that by managing their personal information and choosing the environment in which it is revealed, individuals can accept, reduce, and insure against the risk of loss due to identity theft. SS.912.FL.6.10Compare federal and state regulations that provide some remedies and assistance for victims of identity theft.

Has scrolling through Instagram or your favorite social media account encouraged you to spend more money? CNBC shares that, “For millennials ‘more than any other generation, social media and the allure to spend beyond their means could have long-term negative effects on their finances if they’re not careful” in the article “Social Media May Make You Overspend And Its Not Just Because of Ads.” Upwards of 75% of teens shop online- says PracticalECommerce.com. With online shopping such a convenience, it has become more and more common. Imagine that you were given $100 to spend online. What online shopping site would you look at for your purchase? Have you shopped online before? Write down the last item that you bought online, and why you chose to purchase your good or service over the internet. Did you end up spending what you anticipated? Did you have a plan when you went online to make your purchase? Did you buy only what you initially wanted to purchase or did you add additional items into your cart? Was your online shopping experience a positive experience? Why or why not? What would you do to make a better online shopping experience next time? If you have not purchased online, what could you do to make sure that you are a smart online shopper? Read the attached article, “With Rise of Online Shopping, Has it Saved Us Any Money?” and think about some household benefits and hindrances to shopping online. What does the article identify as a consequence to online shopping for society? Give your opinion for each repercussion on American society.

Check out our new student guide to use with this Use the News activity. We have also created a Nearpod lesson you can use as a slideshow through the preview link or as an editable link. Florida Financial Literacy Standards

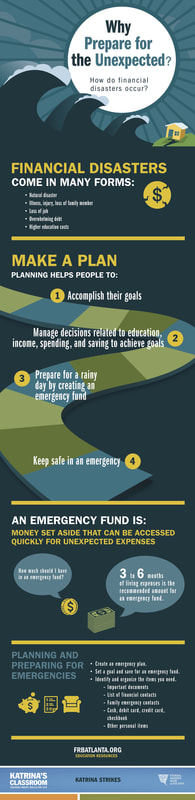

SS.912.FL.2.1: Compare consumer decisions as they are influenced by the price of a good or service, the price of alternatives, and the consumer’s income as well as his or her preferences. SS.912.FL.3.1: Discuss the reasons why some people have a tendency to be impatient and choose immediate spending over saving for the future. SS.912.FL.2.3: Discuss that when buying a good, consumers may consider various aspects of the product including the product’s features. Explain why for goods that last for a longer period of time, the consumer should consider the product’s durability and maintenance costs. SS.912.FL.2.5: Discuss ways people incur costs and realize benefits when searching for information related to their purchases of goods and services and describe how the amount of information people should gather depends on the benefits and costs of the information. How can you prepare for weather emergencies? From Florida hurricanes to the freezing temperatures people faced in the south this winter, Hurricanes are already in the news. From the devastating impact of Hurricane Harvey to the potential impact of rising storms like Irma there are many risks associated with hurricanes. Who could have predicted the massive flooding from Harvey? And flooding is only one of the risks associated with hurricanes. https://www.tampabay.com/hurricane/ Help students understand the risks and how to make decisions on preparing for the risks of hurricanes by using some of the resources on the Tampa Bay Times Hurricane Preparedness web page. You can also check out the geography of the storm on the NIE Tampa Bay Times Mapper Help students prepare for the financial disasters that can occur due to weather. Check out the Federal Reserve lesson plans that were created in the aftermath of Katrina, where you can also download or order copies of the poster, found below, on preparing for Financial Disasters.

You probably have either heard the news or seen memes about the toilet paper shortage at the beginning of COVID. Check out how some people joked about the toilet paper shortage on social media. What do you think? Why do you think toilet paper was in such high demand? Why did it become a scarce resource? Consider the title of the article by the Tampa Bay Times: Nervous shoppers rear-end store shelves. What does "rear-end" mean in another context, like in a car accident? While you are reading consider why the authors used the term "rear-end" to describe what is happening. Also, search for some answers to the question: Why has toilet paper become a scarce resource?

So after you read, why do you think toilet paper has become scarce? Conduct some research online. So what do you think about the toilet paper shortage? How much toilet paper do you think you need? Check out the toilet HowMuchToiletPaper.com to figure out how much paper you need. Now create some mathematical models to figure out how much toilet paper different groups need. Now think of supply and demand in terms of toilet paper during this crisis. Use this Supply and Demand infographic from the Atlanta Federal Reserve to explain what happens when the demand is greater than the supply.

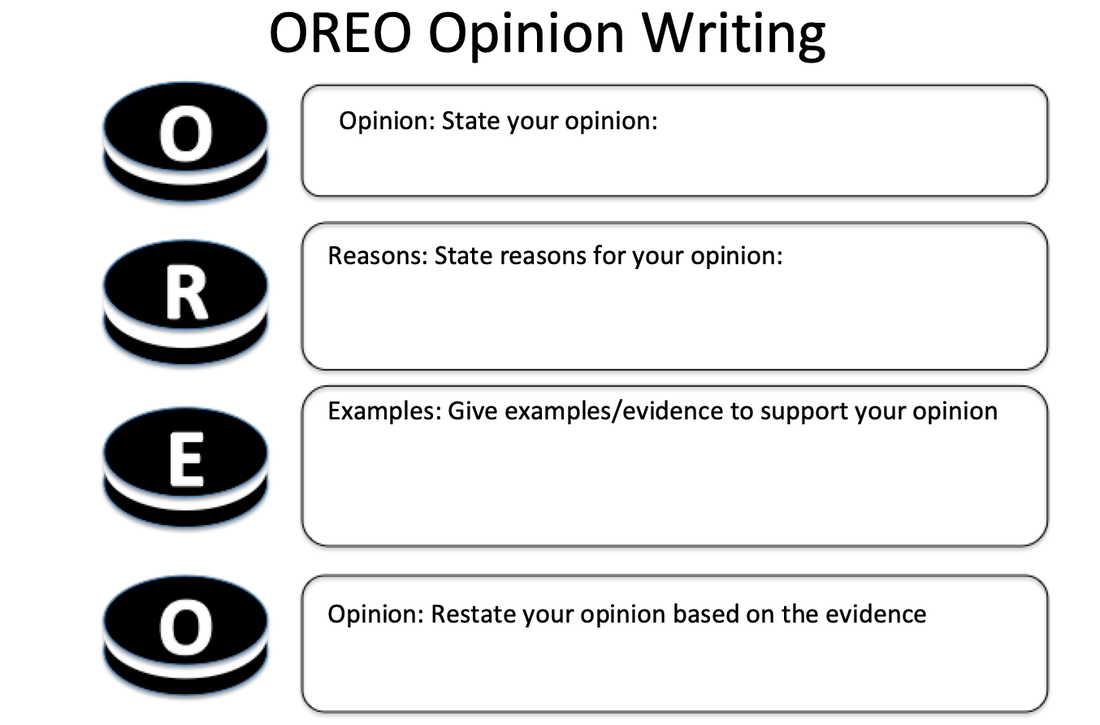

Now apply this to toilet paper. What happens when the demand for toilet paper is greater than the supply? Conduct an online search for examples of price increases during this crisis. Many of the articles discuss "price gauging" as a recent unethical practice. To learn more about price gauging, read what Amazon is doing to unethical sellers who are participating in price gauging. What do you think about the recent price gauging? In your opinion, how is this different from regular practices of supply and demand? Use the OREO opinion writing graphic to organize your thoughts. Then, create an opinion piece, social media post, public service announcement, or meme.

In addition, we have created a Nearpod interactive that you can view or download to edit in your account.

Florida Standards: Financial Literacy-

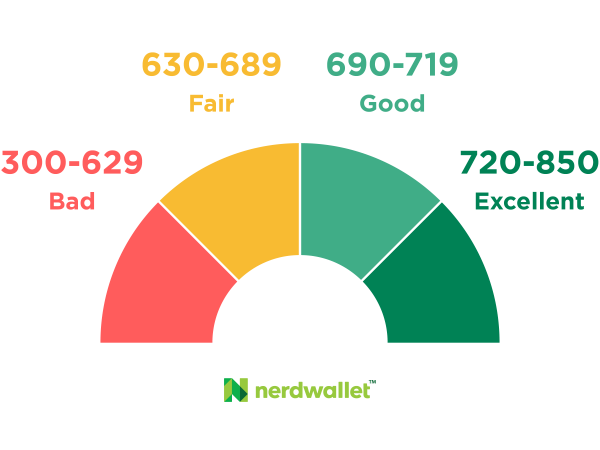

Did you know that a fake charge can impact your credit score? On a piece of paper, write down what you think it means to have a credit score. How many scores can one person have? Why is that? Go to the site creditscorequiz.org and take the quiz. Write down each of the topics and the answers to the questions. How did you perform on the quiz? Would you say that you know about credit scores? What kinds of things did you understand? What did you learn by taking the quiz? Read the Dear Penny article to find out what caused D's credit score to fall? What advice did Penny provide? What surprises you about the article? What factors essentially affect your credit score? Review a sample credit report at MyFloridaCFO.com. Why is it important to review your credit score? Learn more about credit scores by using the engaging interactive at FinanceYourFuture.MyFloridaCFO. To use this with students, check out the student guide we created to accompany this post. Florida Financial Literacy Standards:

SS.912.FL.4.5: Explain that lenders make credit decisions based in part on consumer payment history. Credit bureaus record borrowers’ credit and payment histories and provide that information to lenders in credit reports. SS.912.FL.4.6: Discuss that lenders can pay to receive a borrower’s credit score from a credit bureau and that a credit score is a number based on information in a credit report and assesses a person’s credit risk. SS.912.FL.4.7: Describe that, in addition to assessing a person’s credit risk, credit reports and scores may be requested and used by employers in hiring decisions, landlords in deciding whether to rent apartments, and insurance companies in charging premiums. SS.912.FL.4.13: Explain that consumers are entitled to a free copy of their credit report annually so that they can verify that no errors were made that might increase their cost of credit.

This image was part of the Which Clever Caption Do You Like Best competition from the Tampa Bay Times. This is a perfect image to use when talking about squirreling away money. What does "squirreling away money" mean? What are some words that come to mind when you consider saving money?

What do squirrels, Benjamin Franklin, and Macklemore have in common? Check out our new Nearpod activity to find out!

Here are the Nearpod links:

What is "interest" and how does it help you buy more goods in the future? To discover more about interest rates, watch this Better Money Habits video!

Show what you know: Download the squirrel image (or another squirrel image of your choice) into an app that allows you to add a new caption, speech bubble, or slogan under the theme of squirreling away money. Create your own meme!

Once you have added your text to your image, share it with your friends and family. Extension: What is the difference between real and nominal interest rates? Nominal interest rates tell savers the dollar value of how savings will grow. Real interest rates tell savers about the purchasing power of their savings, which includes adjusting for inflation. Watch Mr. Clifford as he explains the difference!

For more on the difference between real and nominal interest rates, check out the Khan Academy videos.

Financial Literacy Standard : SS.912.FL.3.3:Compare the difference between the nominal interest rate which tells savers how the dollar value of their savings or investments will grow, and the real interest rate which tells savers how the purchasing power of their savings or investments will grow. (Explain how saving can result in getting more goods and services in the future). SS.912.FL.3.2:Examine the ideas that inflation reduces the value of money, including savings, that the real interest rate expresses the rate of return on savings, taking into account the effect of inflation and that the real interest rate is calculated as the nominal interest rate minus the rate of inflation. Read the Dear Penny letter written by “L.” It is obvious that their family is going through financial turmoil. Without reading Penny’s reply, what would you write in response? Would you know where to turn?

Debt is not a goal, yet many Americans find themselves in the hole financially. According to Nerd Wallet, the average household credit card debt surpassed $6,000 in 2018. List some reasons why you believe that households may choose to use credit cards. Identify the ideas on your list as beneficial or detrimental. When might you use a credit card? How would you use a credit card? What does it mean to have a balance on a credit card? Some families are unable to pay off their debt monthly and run into an overwhelming problem where each month they become further and further into debt. Read the Nerd Wallet 2018 American Household Credit Card Debt Study (be sure to look at each graph carefully). Take note of the following:

Students can make a newsletter or social media posts about the knowledge they gained about credit and debt. Where to Turn When There Are No More Pennies to Pinch . . . Here is a copy of the student guide to use with this post. Florida Financial Literacy Standards: SS.912.FL.4.5: Explain that lenders make credit decisions based in part on consumer payment history. Credit bureaus record borrowers’ credit and payment histories and provide that information to lenders in credit reports. SS.912.FL.4.7: Describe that, in addition to assessing a person’s credit risk, credit reports and scores may be requested and used by employers in hiring decisions, landlords in deciding whether to rent apartments, and insurance companies in charging premiums. SS.912.FL.4.8: Examine the fact that failure to repay a loan has significant consequences for borrowers such as negative entries on their credit report, repossession of property (collateral), garnishment of wages, and the inability to obtain loans in the future. SS.912.FL.4.9: Explain that consumers who have difficulty repaying debt can seek assistance through credit counseling services and by negotiating directly with creditors.

Did you know that insurance companies hire actuaries to statistically decide how risky you are based on traits such as your education, zip code, gender, home ownership, driving record, and - in some cases - medical history? They use statistical data to determine which traits predict the least possibility of accidents. To learn more about insurance, check out the Financing Your Future My Florida CFO activities. So, what should you look for in an insurance company? Talk to some friends and brainstorm what are important traits to look for in an insurance company. Share your groups ideas with the class. Do all teams have the same lists? Is it acceptable for different people to look for different things in their insurance companies? How can auto insurance help you? What does it mean to have a high deductible or a low deductible? What are the advantages and disadvantages of each? What is the most appropriate choice for you as a teen? What about your parents? Grandparents? How did you make these decisions? What does the government have to say about automobile insurance? Is there help for picking the right insurance company? Read the attached article about gender and car insurance rates.

What do you think? What do you think would happen if you were a safe driver and your insurance rates went up due to inexperienced or unsafe drivers? What can you do to not be as risky to your insurance company? How soon can you implement these choices into your lifestyle? Now it's time for you to use the data. Check out the data collected by the Insurance Information Institute. If you owned an insurance company, what decisions would you make based on the data? Extension: Draw a cartoon strip with at least 5 bubbles. Write about car insurance and illuminate what is important to the consumer. Check out the student guide to use with this article.

Florida Literacy Standards: SS.912.FL.6.2: Analyze how judgment regarding risky events is subject to errors because people tend to overestimate the probability of infrequent events, often because they’ve heard of or seen a recent example. SS.912.FL.6.3: Describe why people choose different amounts of insurance coverage based on their willingness to accept risk, as well as their occupation, lifestyle, age, financial profile, and the price of insurance. SS.912.FL.6.4: Explain that people may be required by governments or by certain types of contracts (e.g., home mortgages) to purchase some types of insurance. SS.912.FL.6.5: Describe how an insurance contract can increase the probability or size of a potential loss because having the insurance results in the person taking more risks, and that policy features such as deductibles and copayments are cost-sharing features that encourage the policyholder to take steps to reduce the potential size of a loss (claim). SS.912.FL.6.6: Explain that people can lower insurance premiums by behaving in ways that show they pose a lower risk. “Porch Pirates AKA Delivery Theft” What do you know about Porch Pirates? Read the article and create a social media post to tell a friend about the problem or a solution.

Consumers love their Amazon! Even after porch pirates seem to get away with stealing shopper’s “delivered” online shopping purchases, it does not seem to slow consumer spending. Amazon looked into a theft ring that involved a delivery service (drivers) contracted by Amazon, stealing purchases and then reselling the stolen items.

Companies like Walmart and Amazon have found that consumers have not lost trust in these businesses, and continue to buy, allowing at-home deliveries to continue. Some online merchants will replace items not received by mail if you can prove that it was never delivered. Most businesses have turned to mail tracking services to ensure that their products are shipped out and they can be located in the shipping process; which in turn safeguards delivery of the item. Shopping online is always a risk. Write down what risks are involved when using the internet to purchase goods or services. Next to each item, provide a way to help minimize that risk. Circle the risks that you cannot minimize with additional proactive steps. What are the benefits to shopping online? Do you prefer to shop at a brick and mortar businesses, or buy online? Why? Have you ever had a negative shopping experience online? How was it resolved? Extension: Go online to your favorite online retailers and find out what their policy is regarding missing packages. Research at least 5 different merchant policies. Create a spreadsheet to analyze their shipping policies. Compare your results and list them as SAFE or UNSAFE for the consumer. Florida Financial Literacy Standards: SS.912.FL.6.1: Describe how individuals vary with respect to their willingness to accept risk and why most people are willing to pay a small cost now if it means they can avoid a possible larger loss later. SS.912.FL.6.9: Explain that loss of assets, wealth, and future opportunities can occur if an individual’s personal information is obtained by others through identity theft and then used fraudulently, and that by managing their personal information and choosing the environment in which it is revealed, individuals can accept, reduce, and insure against the risk of loss due to identity theft. “A Data Breach By Any Other Name Would Be Just As Sour” This article-based activity includes a student guide that allows for a self-paced experience. Check out the student guide or download it below.

What is your biggest fear when it comes to owning a credit card? Making payments on time? Not trusting yourself to stay within your limits to pay your bill off in full every month? Not letting the convenience of a “swipe” get to your head and embark on an adventure filled with debt? The least of your worries should be a criminal accessing your very own private information. Regardless of what we call a “data breach”- potential identity theft is just as unnerving. Unfortunately in our digital age, we need to be very aware and cautious when it comes to providing our personal information to others. What kind of sensitive information is super valuable to criminals? What kinds of things can someone do with that information? How can you protect yourself from being a victim of identity theft? Read the article attached and think about what happens when data thieves steal your name, social security number and birth date?

Record a list of steps to take when your personal information has been leaked. Partner with a classmate and create a tweet (240 character count) to educate the public on what a wise consumer would do if affected by a data breach. Be sure to use the hashtag #usfFinLitBlogPost if you decide to tweet your response.

Florida Literacy Standards: SS.912.FL.6.9: Explain that loss of assets, wealth, and future opportunities can occur if an individual’s personal information is obtained by others through identity theft and then used fraudulently, and that by managing their personal information and choosing the environment in which it is revealed, individuals can accept, reduce, and insure against the risk of loss due to identity theft. SS.912.FL.6.10: Compare federal and state regulations that provide some remedies and assistance for victims of identity theft. What happens when your smart home technology takes on a life of its own? Check out or download the student guide (.doc or .pdf) below.

Imagine sitting in your living room and hearing a mysterious voice on your Amazon Ring or Google Next speakers! How do you think this could happen? Check out this article on the Tampa Bay Times NIE Front Page Talking Points: What Consumers Need to Know About Security Camera Hacks. Based on the title, what do you think you will learn? For example, what is a hack? For example, have you heard about people hacking into computers and taking control of data? What do you think that has to do with security cameras? While you read, take note of things you think a consumer needs to know about security camera hacks.

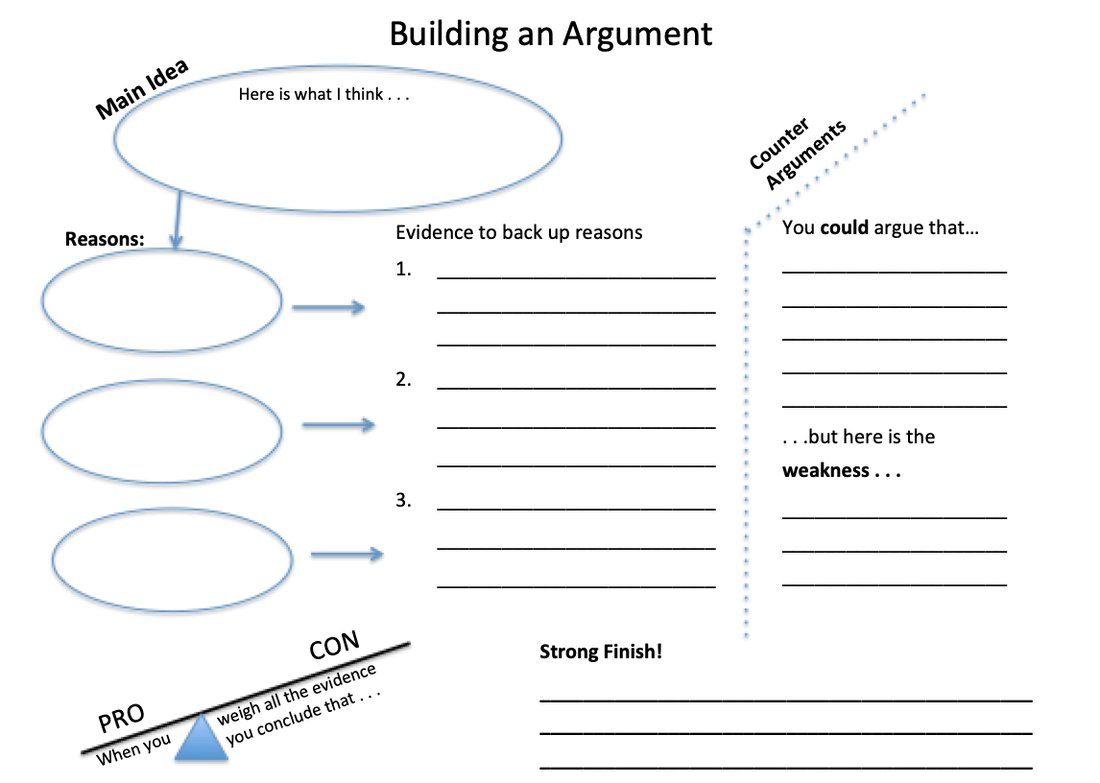

What did you discover? How does this information impact you as a consumer? What did you learn? Based on what you learned, would you choose to buy or not to buy? Why? What is the opportunity cost of your decision? Conduct some online research about security cameras. How does research impact buying decisions? Now check out the news video about the same story. While you watch, take more notes. Here are three different perspectives from stakeholders: Ring (the company) says: "Ring believes when communities and local police work together, safer neighborhoods can become a reality." -- Yassi Shahmiri, company spokeswoman Critic (a technology expert) says: "Ring should be shut down immediately and not brought back. The privacy issues are not fixable with regulation, and there is no balance that can be struck. They are simply not compatible with a free society." – Max Eliaser, Amazon engineer Journalist says: "I spent a couple weeks using an Amazon Ring doorbell camera. I didn't like how it made me feel about my neighborhood, or how i thought it might make my neighbors feel about me." – Max Read, New York magazine writer and editor Which perspective do you think most fits the evidence you found in the article, video, and other online research you conducted? Do you agree with any of the three perspectives or did you create your own perspective, based on the evidence you found? You can use the graphic organizer below to build an argument. Then, you can either write an argument essay/blog post or have a debate with some friends or family members.

Extension: What do you think the government's role should be in these types of issues dealing with consumer products?

Florida Standards: Financial Literacy-

Dashed dreams are a reality when it comes to the lotto. Americans are spending about $70 billion dollars a year on lottery tickets. What percent chance do you think an individual has to score a winning ticket? Are the odds in your favor, or against you? Think for a moment about why someone may choose to spend money on the lottery. Here is the student guide to use with this post

Read the article “Lottery Dreams” and write down how you could use $273 a year instead of gambling it away.

Use an investment calculator, like one found at Calculator.net, https://www.calculator.net/investment-calculator.html and put the $273 in the calculator for the starting amount of the investment, with a modest return of 6% each year, entering $273 additional each year, how much could you have in 10 years? What about 20? What happened to the total from 10 to 20 years? Why did it more than double? Would you rather have a 1 in 175,000,000 chance at winning, or the total $273 invested over time?

Use the articles to create an infographic that looks like a lottery ticket.

Florida Literacy Standards: SS.912.FL.2.1: Compare consumer decisions as they are influenced by the price of a good or service, the price of alternatives, and the consumer’s income as well as his or her preferences. SS.912.FL.3.1: Discuss the reasons why some people have a tendency to be impatient and choose immediate spending over saving for the future. SS.912.FL.3.3: Compare the difference between the nominal interest rate which tells savers how the dollar value of their savings or investments will grow, and the real interest rate which tells savers how the purchasing power of their savings or investments will grow. SS.912.FL.2.5: Discuss ways people incur costs and realize benefits when searching for information related to their purchases of goods and services and describe how the amount of information people should gather depends on the benefits and costs of the information. SS.912.FL.5.10: Explain that people vary in their willingness to take risks because the willingness to take risks depends on factors such as personality, income, and family situation. SS.912.FL.6.1: Describe how individuals vary with respect to their willingness to accept risk and why most people are willing to pay a small cost now if it means they can avoid a possible larger loss later.

When you think of the Classifieds section of the newspaper, what do you think about? Do you find classifieds in the local newspaper or online? Check out the new student guide we created to accompany this post.

The earliest newsprint ad on American soil was in the Boston News-Letter in 1704. Printed ads actually date all the way back to 2000 BCE in Egypt. Rather than physically printing the ad on paper (or papyrus at the time), it was etched in the side of a pyramid. Outdoor advertising at its finest. By 59BCE, Rome was printing daily ads in the “Daily Acts” (Acta Diurna), a sort of daily gazette. Check out the history of the “classifieds” in this infographic.

From Visually.

The classified are not just for selling a boat, a baseball card collection, or kittens; nor are they only for posting a lost pooch. Did you know that the Classified section of the newspaper can provide a starting place for those seeking a job? Check out the recent classified in a newspaper like the Tampa Bay Times or use the embedded section.

What kinds of jobs do you see listed? Play around with grouping them into a few categories. What does that look like? Are there any ads listed that interest you? Choose one ad that catches your attention.

Extensions:

Florida Literacy Standards: SS.912.FL.1.1: Discuss that people choose jobs or careers for which they are qualified based on non-income factors, such as job satisfaction, independence, risk, family, or location. SS.912.FL.1.3: Evaluate ways people can make more informed education, job, or career decisions by evaluating the benefits and costs of different choices. SS.912.FL.1.4: Analyze the reasons why the wage or salary paid to workers in jobs is usually determined by the labor market and that businesses are generally willing to pay more productive workers higher wages or salaries than less productive workers. In a recent journal article, Katz, Vaught, and Simmens (2019) defined social distancing as: "the practice of restricting contact among persons to prevent the spread of infection." Check out the student guide you can download to use with this activity.

To find out more about social distancing, view the CBC video. What is it? Why is social distancing being recommended? Now, read the Tampa Bay Times article on the do’s and don’ts of social distancing. While you read, record their suggestions. Then, conduct some online research to find more do's and don'ts.

Then use the Consumer Reports article to find some suggestions about how to socialize at a distance during the coronavirus outbreak. What do you think?

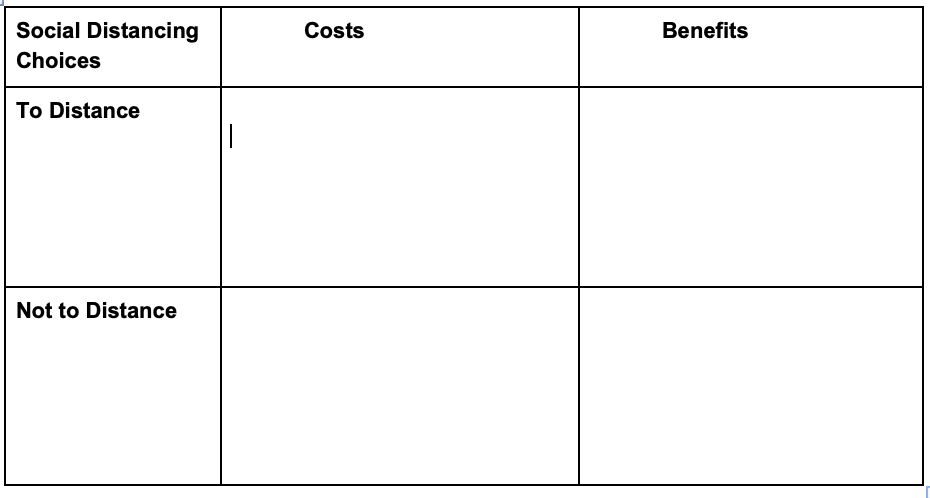

What did you learn? During these troubling times, many events have been cancelled, and businesses temporarily closed or limited for service. What are the Costs and Benefits of the choices: To Distance or Not to Distance? Evaluate the costs and benefits of social distancing. What are some of the future unintended consequences of spreading the virus to vulnerable people? What are some of the possible economic consequences of social distancing? How could some of these changes impact workers' incomes?

Spread the news, not the achoos! That is a potential slogan for a meme or other social media post. Create your own meme by using an online meme generator or download the free Chatterpix app (App Store) or (Google Play) to make a talking meme. Florida Standards: Financial Literacy-

This is a question that many people have asked during this crisis. Before you panic, this activity will help you find solutions. Check out the student guide to use with the inquiry activity.

Check out this video that was created by CBC Kids News. What did you learn from the informational video? One of the problems is that people are hoarding vast amounts of goods. What are the consequences of this decision? How does this impact other consumers? The next clip, which is part of the Tampa Bay Times NIE News Video collection, begins with a question: Why did Walmart announce shortened store hours? What did you discover? Walmart stated the shorter hours will "help ensure associates are able to stock the products our customers are looking for and to perform cleaning and sanitizing." How is this helping to protect the food supply? What goods has your family been buying? What are some of the goods your family might need? Check out this Consumer Reports article to see what they recommend.

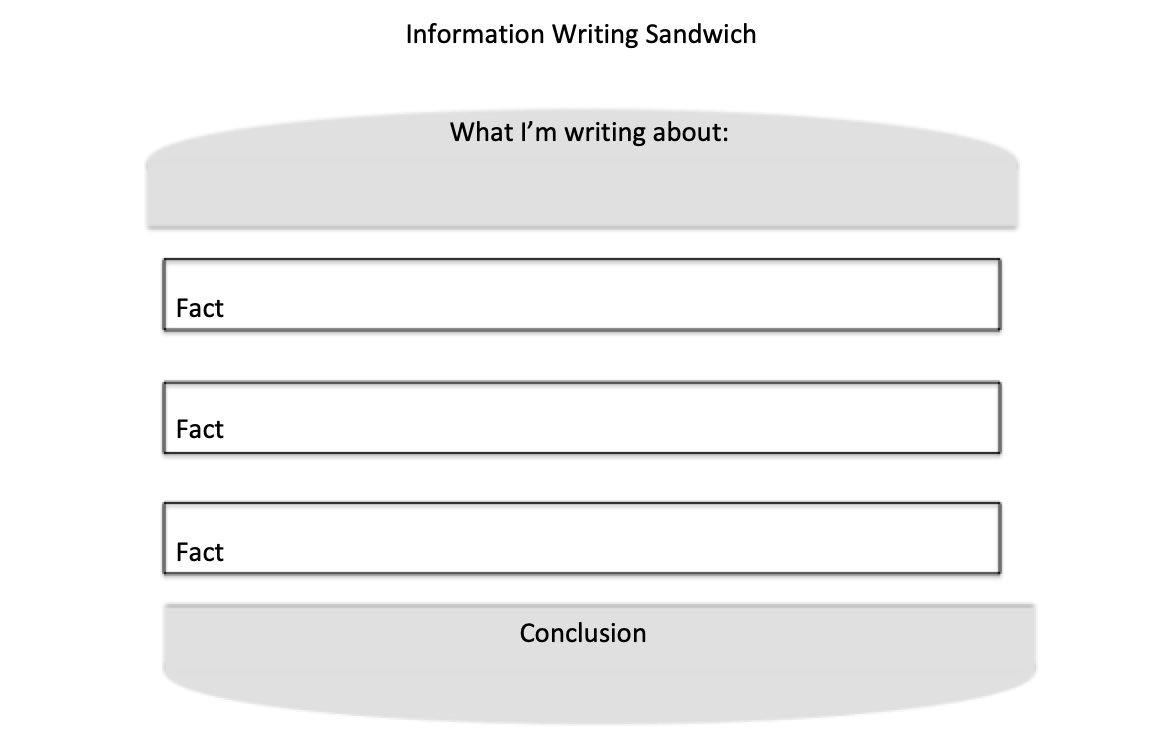

Conduct more research online. What are things the average family might need? After you complete your research, use the information writing sandwich to plan an article, public service announcement or blog post. Extensions:

Financial Literacy-

How has COVID-19 impacted your life? What are some of the consumer choices you have had to make? Have you noticed any scarcity problems? Check out the Student Guide we created to go with this lesson.

Watch the CBC Kids News video that recaps teen reactions to the coronavirus in Canada. This video was made by teens in Canada. What are similarities and differences with the impacts you have felt in the place where you live? What was the first thing that made you realize that COVID-19 was a big deal? There have been many things like event cancellations, business shut-downs, and panic purchases. For example, check out our post on Why Toilet Paper? Then, there were the public service announcements, videos, and memes on hand-washing. Check out the post we did on Hamsters and Hand-washing. The COVID-19 pandemic has created financial and social-emotional consequences for many individuals. How has it impacted you? How have your buying choices been impacted? What about event cancellations? For example, were you impacted by concert or sports cancellations? Now, check out this Tampa Bay Times Newspaper in Education News Video on Sports and COVID-19. How were you personally impacted by sports cancellations? How were others impacted? Consider the players and all of the people who work at the stadiums. What are the costs and benefits of closing stadiums during the pandemic? There have been many news articles about how sports players and team owners have been helping the workers who have been impacted. Search the news and find some articles and videos about players or team owners who have supported the laid-off workers. How do you feel about the teams who support the workers? Find other examples of people who are doing good things for others during these hard times. Create a social media post about someone you caught doing #COVID-19GoodDeeds.

Florida Standards: Financial Literacy-

Why should this hamster wash its hands before eating the peanut? In this post, we provide a variety of sources to use with students to understand responsible decision-making during COVID. Before you begin reading, check out and download the student guide we created to accompany this post.

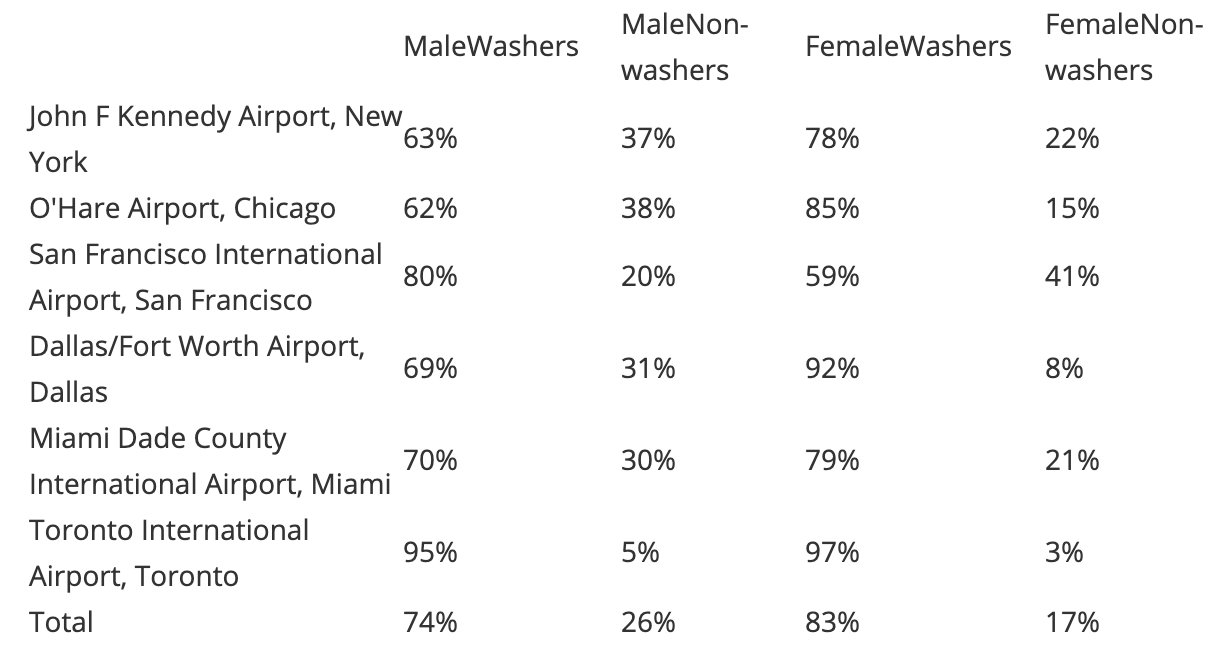

During the COVID-19 outbreak, you may have seen videos on TikTok, like the hamster giving advice against #CoronaVirus. Like the hamster video, the CDC recommends washing your hands often for at least 20 seconds. Washing your hands is a good decision, but not a choice people always make! In 2003, a survey by the American Society for Microbiology reported that almost 30 percent of people don't wash their hands after using the restroom at airports. In the article, they provided this table of results from different airports. What did you notice? Which airport had the most hand washers? Why do you think Toronto International Airport had the most hand washers in 2003? What happened in 2003 that might have influenced individuals in Toronto to wash their hands? According to the CDC, in 2003, Toronto, Canada experienced a major SARS outbreak. How do outbreaks like SARS or COVID-19 impact our decision-making? How can not washing your hands impact your health and wealth? MIT news reported on a study of hand washing that used epidemiological modeling and data-based simulations to model hand washing at airports. Based on past findings, the research team estimated that on average only 20 percent of people in airports have clean hands–where they have washed their hands at least 15 seconds, within the last hour. Through modeling they estimated that tripling the rate to 60 percent could potentially slow disease spread by 70 percent! The researchers recommended using education, posters, and public service announcements to increase the prevalence of clean hands. Like the hamster hand washing video, many other public service announcements have flooded social media globally. One of the most popular videos was the TikTok dance challenge created to fight the coronavirus. Before you watch the Inside Edition news video, think about how the impact of hand washing on the spread of a virus. Then, during viewing, take notes on how hand washing can get rid of the germs that cause illness. The TikTok Dance Challenge to Fight Coronavirus spread virally, inspiring people to upload their own songs and dances. Now check out the Baby Shark and CBC Kids News hand washing challenges.

After viewing: What did you learn? How did the Public Service Announcement use persuasive language, images, and sound? How can you use these strategies in your own Public Service Announcement? Now, consider some of the reasons why should convince people to wash their hands. What are the potential financial consequences of not washing hands? What about the economic impact on a business? Use the persuasive planning organizer to record your ideas. Then create your own song or performance about hand washing!

As a second activity, check out the article we pulled from this week's Tampa Bay Times NIE Use the News: Trash Those Wipes. Before you read, think about the title. What do you think Trash Those Wipes means? While you read Part 1 of the article, mark the text and take notes about the problems wipes can cause and the solutions recommended in the text.

After reading Part 1, organize your thoughts into the problem-solution organizer.

Now read Part 2 of the text. Find and read articles about people and businesses disinfecting surfaces. Create ads or social media posts about making the decision to disinfect surfaces. Extension: What are some of the jobs that are important during this COVID-19 outbreak. Consider the medical profession, education, and businesses who are manufacturing essential goods. Conduct some online research about the professions. What training and skills are required? What are the costs and benefits of making different career choices? Florida Standards:

Financial Literacy-

On this page, you will find the materials for webinars held on August 3, 2020.

Download the Google Slides.

Here is the presentation nearpodStudent Nearpods: PreView, edit, or pdf

Please fill in the evaluation form.

Download Link for Google Slides.

Nearpod lessons

Elementary/Middle Saving: Download the editable link to adapt the activities.

Secondary: Use the News to Save for the Future editable link

Squirrels, Macklemore, and Benjamin Franklin: Here is the editable link.

Please fill in the evaluation form

Check out the student guide that you can use with this post.

What is the biggest motivating factor in your life? Do you find that negative consequences or positive rewards are more effective when helping you make choices? Can you remember a period in American history (prior to 2020), in which there were significant economic consequences to individuals? Today, Americans, and individuals throughout the global economy have found fear as a motivating factor to help them make decisions about what to do with money they have invested in the stock market. What global event (in the first few months of 2020) has caused individuals to fear the risk of investing their money in the stock market? Take a look at the “Cartoons for the Classroom: Is fear the worst viral epidemic?” What do you see in the cartoon (by Dave Whamond) in the upper left hand part of the page? What do you think is happening? What do you wonder?

How may this cartoon show what is happening in the American or global marketplace? Behavioral Economist Daniel Kahneman provides a quote for the Between the Lines, in which he states: "The world in our heads is not a precise replica of reality. Our expectations . . . are distorted by the prevalence and emotional intensity of the messages to which we are exposed."

|

Archives

January 2022

CategoriesAuthorDeborah Kozdras, Ph.D. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RSS Feed

RSS Feed