|

Check out and download our new student guide to use with this article-based lesson!

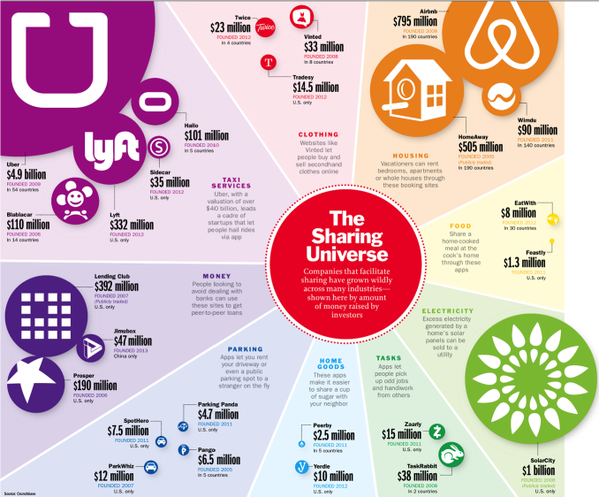

Many people in today’s society are earning their income in a “pay per job” market. As of 2016, around twenty to thirty percent of the working age population has earned money outside of a typical salaried or hourly pay job. Why do you think this statistic has increased so much over the years? Now read the Tampa Bay Times article below to discover more about the "gig" economy.

The job industry is thriving with entrepreneurial growth. Uber, Lyft, AirBnB, DoorDash and Postmates are just some of the opportunities that allow individuals to earn money around their own schedules, rather than that of their employer. When individuals earn wages on a “individual contract basis,” what does the worker need to take into account? After reading the article below, consider: How has technology changed the job market? Are technological changes helping or hurting the job market? As a student looking for a part time job, free-lance work or gigging may be great opportunities. Create a resume of your work experience, leadership and current responsibilities that show your marketability for an independent contract job. Investigate your earning with a gig job and compare to a local fast-food restaurant’s hourly wage. What can you find out?

Extension: Act as employer and write an ad for a job in a “gig economy.” Make sure to identify both the job qualifications and the personal qualities you need in your employee. Florida Financial Literacy Standards: SS.912.FL.1.1 Discuss that people choose jobs or careers for which they are qualified based on non-income factors, such as job satisfaction, independence, risk, family, or location. SS.912.FL.1.2 Explain that people vary in their willingness to obtain more education or training because these decisions involve incurring immediate costs to obtain possible future benefits. Describe how discounting the future benefits of education and training may lead some people to pass up potentially high rates of return that more education and training may offer. SS.912.FL.1.3 Evaluate ways people can make more informed education, job, or career decisions by evaluating the benefits and costs of different choices. SS.912.FL.1.5 Discuss reasons why changes in economic conditions or the labor market can cause changes in a worker’s income or may cause unemployment. Florida Economics Standards: SS.912.E.1.9 Describe how the earnings of workers are determined. Check out our new student guide to use with this article-based lesson!

Keep Your Lips Zipped When You Shop! When is the last time you have been on a car lot? Have you flipped through an Automobile Sales Flyer or scrolled online to find your dream car? Did you know that what you say “can, and will be held against you?” There are five topics you must tame your tongue to avoid! Before reading the article, 5 things not to say when you're buying a car, come up with a quick list of items that you may not want to share with a car salesperson. Compare it to the list in the article below.

Part of the battle in purchasing a car is comparison shopping to ensure you are making the best decision. You must weigh information about each vehicle in comparison to each other. Think about such items as price, affordability, auto features, repair costs and your own intention for use and need to a vehicle. Read the article attached and write a short response illuminating the consequences of purchasing a vehicle that just meets or exceeds your price range. What are the consequences to this? Does this affect anyone other than yourself; how so?

Extension: Explore the laws and institutions provided for consumers to help gain adequate information about vehicles. Make a brochure to identify and explain these laws and institutions to another consumer. Florida Financial Literacy Standards: SS.912.FL.2.1 Compare consumer decisions as they are influenced by the price of a good or service, the price of alternatives, and the consumers income as well as his or her preferences. SS.912.FL.2.2 Analyze situations in which when people consume goods and services, their consumption can have positive and negative effects on others. SS.912.FL.2.3 Discuss that when buying a good, consumers may consider various aspects of the product including the product’s features. Explain why for goods that last for a longer period of time, the consumer should consider the product’s durability and maintenance costs. SS.912.FL.2.5 Discuss ways people incur costs and realize benefits when searching for information related to their purchases of goods and services and describe how the amount of information people should gather depends on the benefits and costs of the information. SS.912.FL.2.7 Examine governments establishing laws and institutions to provide consumers with information about goods or services being purchased and to protect consumers from fraud. Check out and download our new student guide for this lesson!

Unnerving university loans have students second guessing college Taking a risk by going to college and investing in yourself can be scary. Many students take out loans to get through their university experience. The career that they land as a result of furthering their education may or may not pay the bills for the debt. New college grads are finding that taking out loans for college does not always “pay" as illustrated in the Cartoons for the Classroom activity from the Tampa Bay Times Newspaper in Education.

Consider your future career choice and if a degree is needed. What does the average pay look like for your career in the town you would like to work? What is the demand for the career itself? Is there a high occupational outlook? Be sure to weigh the choices in fields where a university education is not needed. If you can work your way through college, even taking an extra year or two- you may be able to graduate without school loans. Depending on the repayment structure for your college loan, it may be years before you pay off any of the principal. What have you heard about college debt? Is it worth it? Search for a “Student Loan Calculator” online. <https://www.bankrate.com/calculators/college-planning/loan-calculator.aspx> Find out how much it costs to take out a loan for $5,000, $10,000 and $50,000 over a 10 year period of time. Create a grid that shows the payments for each with 4%, 5% and 6% interest rates. What would it look like if you take 20 years to pay off your loans? What are the consequences of not paying these loans in a timely manner? What if you miss a payment? Write a paragraph to explain the best choice for you, make sure to explain why.

For more https://www.econedlink.org/resources/how-will-i-pay-for-college/ Extension: Research your chosen career in a specific town and compare the pay to cost of living. Create a budget and find out how much money you have available and are willing to put towards student loans. Florida Financial Literacy Standards: SS.912.FL.4.1 Discuss ways that consumers can compare the cost of credit by using the annual percentage rate (APR), initial fees charged, and fees charged for late payment or missed payments. SS.912.FL.4.8 Examine the fact that failure to repay a loan has significant consequences for borrowers such as negative entries on their credit report, repossession of property (collateral), garnishment of wages, and the inability to obtain loans in the future. SS.912.FL.4.9 Explain that consumers who have difficulty repaying debt can seek assistance through credit counseling services and by negotiating directly with creditors. |

Archives

January 2022

CategoriesAuthorDeborah Kozdras, Ph.D. |

|||||||||||||||||||||||||||||||||||||||

RSS Feed

RSS Feed