|

Did you know that the word "Benjamins" is slang for money? Check out the All About the Benjamins supplement from the Tampa Bay Times to learn more about money.

Benjamin Franklin was a great believer in thrift. In fact, from 1732-1758, he created a publication Poor Richard's Almanac(k) - written under the pseudonym of "Poor Richard" or "Richard Saunders." Saving is difficult. We have unlimited wants and have to make decisions about saving vs. spending. In order to understand the basics of saving, check out Practical Money Skills and try their Saving for a Goal calculator. After you have learned the basics, use the NIE Supplement All About the Benjamins to gather ideas to use in a social media post about thrift. For example, you can create an instagram or twitter post about thrift. Or you can create a short video public service announcement or an infographic.

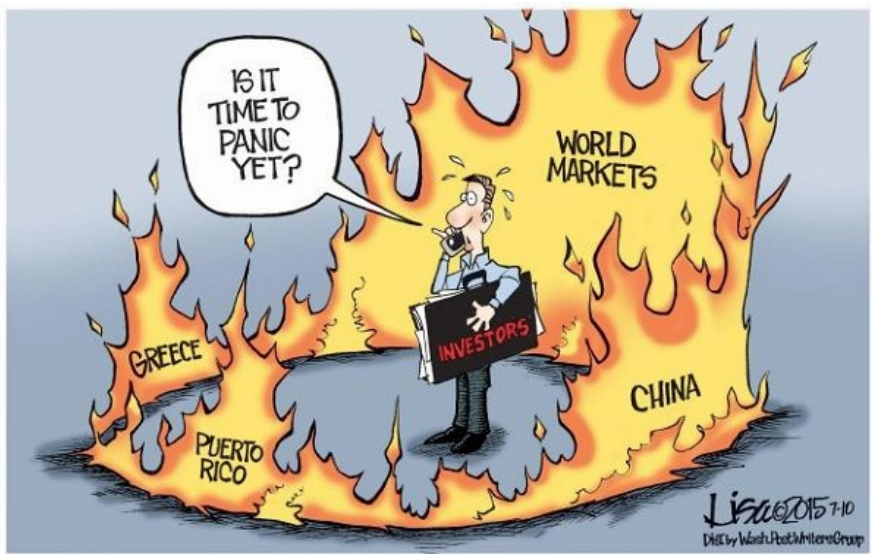

Standards SS.8.FL.3.7 Discuss the different reasons that people save money, including large purchases (such as higher education, autos, and homes), retirement, and unexpected events. Discuss how people’s tastes and preferences influence their choice of how much to save and for what to save. SS.912.FL.3.1:Discuss the reasons why some people have a tendency to be impatient and choose immediate spending over saving for the future. This political cartoon was created in 2016 and made available from from the NIE and Association for American Editorial Cartoonists (AAEC) Cartoons in the Classroom program to discuss the stock market. Check out the information in the pdf of the political cartoon to describe describe how the stock market may adjust to news of panic in world markets. That was then and this is now. What are some world events that have caused shifts in the stock market in the past? What about the present? Choose an event and create your own cartoon or meme about the event. Financial Literacy Standard SS.912.FL.5.7:Describe how financial markets adjust to new financial news and that prices in those markets reflect what is known about financial assets. In the past, there were many jobs for people who didn't know how to use computers. Today, most jobs require digital literacy. Many workers have gone back to school to take computer and other technology classes. The ability to understand coding is essential for many jobs of today and tomorrow. What technology skills do you have? What technology skills do you need? Check out the Newspaper In Education supplement from the Tampa Bay Times: Exploring Creativity Through Mobile App Development. Think of a problem you have. What kind of app could you develop to solve the problem?

Standards

SS.8.FL.1.2 Identify the many decisions people must make over a lifetime about their education, jobs, and careers that affect their incomes and job opportunities. SS.8.FL.1.3 Explain that getting more education and learning new job skills can increase a person’s human capital and productivity. SS.8.FL.1.4 Examine the fact that people with less education and fewer job skills tend to earn lower incomes than people with more education and greater job skills. SS.912.FL.1.3: Evaluate ways people can make more informed education, job, or career decisions by evaluating the benefits and costs of different choices. SS.912.FL.1.4: Analyze the reasons why the wage or salary paid to workers in jobs is usually determined by the labor market and that businesses are generally willing to pay more productive workers higher wages or salaries than less productive workers. SS.912.FL.1.5: Discuss reasons why changes in economic conditions or the labor market can cause changes in a worker’s income or may cause unemployment.

Watch this NIE video of the week on smoking bans. What do you think about the smoking bans? Why are some people willing to smoke and accept the risk? Why are people willing to pay for health insurance if they can avoid a larger loss later, especially if they participate in risky behaviors? Should smokers pay more for health insurance? Why or why not?

What about life insurance? Download the Life Insurance article below. How much more would a smoker pay than a healthy 30-year old woman for a $1 million policy with a 20-year-term? A healthy 30-year old man? A 45-year old woman for a $500,000 policy with a 30-year-term? How much more for a male smoker? What advice would you give to a male smoker who wants to lower his insurance premiums?

Financial Standards

SS.912.FL.6.1:Describe how individuals vary with respect to willingness to accept risk and why most people are willing to pay a small cost now if it means they can avoid a possible larger loss later. SS.912.FL.6.6:Explain that people can lower insurance premiums by behaving in ways that show they pose a lower risk. |

Archives

January 2022

CategoriesAuthorDeborah Kozdras, Ph.D. |

||||||||||||||||||||||||||

RSS Feed

RSS Feed