|

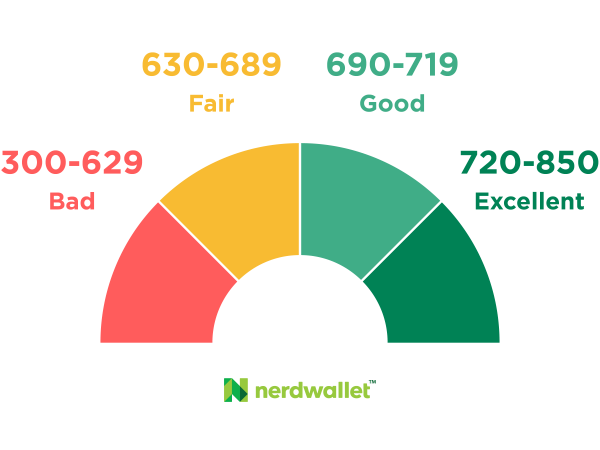

Did you know that a fake charge can impact your credit score? On a piece of paper, write down what you think it means to have a credit score. How many scores can one person have? Why is that? Go to the site creditscorequiz.org and take the quiz. Write down each of the topics and the answers to the questions. How did you perform on the quiz? Would you say that you know about credit scores? What kinds of things did you understand? What did you learn by taking the quiz? Read the Dear Penny article to find out what caused D's credit score to fall? What advice did Penny provide? What surprises you about the article? What factors essentially affect your credit score? Review a sample credit report at MyFloridaCFO.com. Why is it important to review your credit score? Learn more about credit scores by using the engaging interactive at FinanceYourFuture.MyFloridaCFO. To use this with students, check out the student guide we created to accompany this post. Florida Financial Literacy Standards:

SS.912.FL.4.5: Explain that lenders make credit decisions based in part on consumer payment history. Credit bureaus record borrowers’ credit and payment histories and provide that information to lenders in credit reports. SS.912.FL.4.6: Discuss that lenders can pay to receive a borrower’s credit score from a credit bureau and that a credit score is a number based on information in a credit report and assesses a person’s credit risk. SS.912.FL.4.7: Describe that, in addition to assessing a person’s credit risk, credit reports and scores may be requested and used by employers in hiring decisions, landlords in deciding whether to rent apartments, and insurance companies in charging premiums. SS.912.FL.4.13: Explain that consumers are entitled to a free copy of their credit report annually so that they can verify that no errors were made that might increase their cost of credit. Comments are closed.

|

Archives

January 2022

CategoriesAuthorDeborah Kozdras, Ph.D. |

RSS Feed

RSS Feed